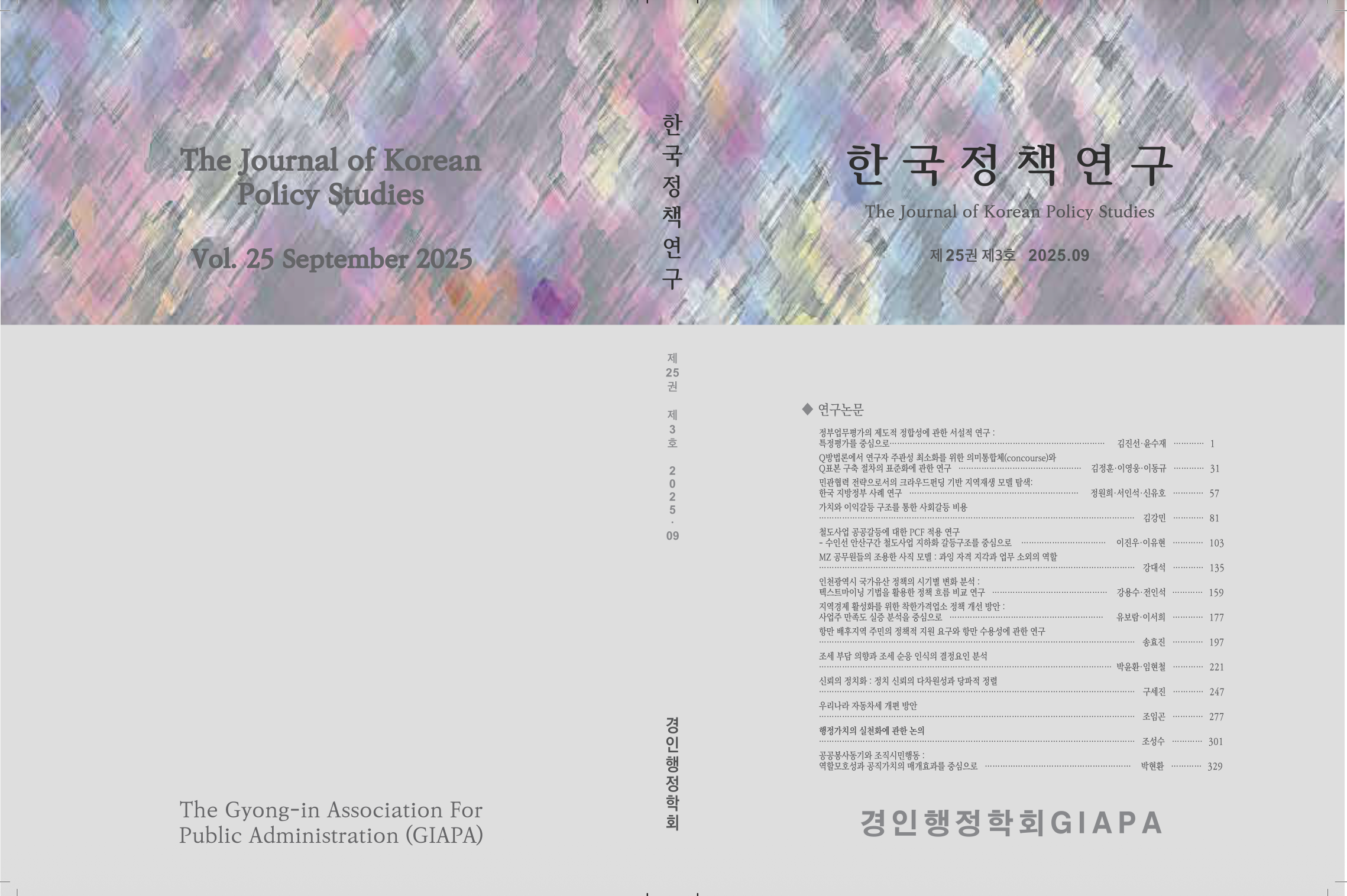

조세 부담 의향과 조세 순응 인식의 결정요인 분석

Determinants of Tax Payment Willingness and Tax Compliance Perception

저자

박윤환, 임현철

Yoonhwan Park, Hyunchul Lim

Yoonhwan Park, Hyunchul Lim

- 창간연도

- 2002년 2월

- ISSN

- (Print)1598-7817 , (Online)2713-6744

- 등재사항

- KCI등재(2019.01 ~ 현재)

- 수록권호

- 제25권 3호

- 발행일

- 2025.09

- 수록논문

- 14 articles

- 유형

- 학술저널

- 주제

- 사회과학

- 발행기간

- 2002.02 ~ 2025.12

- 발행주기

- 연 4회(계간)

- 총 권호 수

- 78 volumes

- 총 논문 수

- 771 articles

초록

본 연구는 저소득층 복지를 위한 조세 부담 의향과 조세 순응 인식이 개인의 경제적 측면 외에도 정치·사회적 특성, 정부 신뢰, 공공서비스에 대한 경험, 인구 및 거주 특성에 이르는 다양한 요인에 의해 좌우될 수 있다는 점을 실증적으로 규명하는 것을 목적으로 한다. 이를 위해 2023년 사회통합실태조사 자료를 활용하여 저소득층 복지를 위한 조세부담 의향과 조세순응 인식의 결정요인 분석 모형을 수립하여 다중회귀분석을 통해 결과를 도출하였다. 분석 결과에 따르면 우선 조세부담 의향은 포용성, 경제력, 소득, 정부·대인신뢰, 진보적 정치성향, 사회적 지위, 삶의 만족도에 의해 긍정적 영향을 받는 것으로 나타났다. 이에 반해 납세공정성 인식과 지역 소속감은 조세부담 의향에 부정적 영향을 주었다. 조세순응 인식의 경우는 공공서비스 경험, 공적연금 가입, 대인신뢰, 납세공정성, 포용성, 소속감, 연령, 자가거주, 삶의 만족도 요인들이 긍정적 영향을 미쳤으나, 경제력, 정부신뢰, 사회적 지위는 부정적 영향을 주는 것으로 확인되었다. 이러한 결과는 조세부담 의향이 상대적으로 가치적 측면의 요인들에 의해, 조세순응 인식은 제도적 신뢰와 규범적 요인에 의해 상대적으로 더 강한 영향을 받는다는 점을 시사한다. 분석 결과에 기초하여 조세부담 의향과 조세순응 인식을 높이기 위한 노력이 포용성 제고, 공정성 강화, 집단별 맞춤형 전략을 통해 마련될 필요가 있다는 점을 정책적 함의로 제시하였다.The purpose of this study is to empirically examine the factors influencing individuals’ intention to bear tax burdens for the welfare of low-income households and their perception of tax compliance. Beyond individual economic conditions, such intentions and perceptions may also be shaped by political and social characteristics, trust in government, experiences with public services, and demographic and residential attributes. Using data from the 2023 Social Integration Survey, this study developed an analytical model to identify the determinants of tax burden intention and tax compliance perception, and employed multiple regression analysis to derive the results. The findings indicate that tax burden intention is positively associated with inclusivity, economic capacity, income, trust in government and others, progressive political orientation, social status, and life satisfaction. Conversely, perceptions of tax fairness and regional belonging were found to exert negative effects. With respect to tax compliance perception, positive influences were observed from public service experience, public pension participation, interpersonal trust, perceived tax fairness, inclusivity, sense of belonging, age, homeownership, and life satisfaction, whereas economic capacity, government trust, and social status showed negative effects. These results suggest that tax burden intention is relatively more influenced by value-oriented factors, while tax compliance perception is more strongly shaped by institutional trust and normative considerations. Based on these findings, the study highlights policy implications, emphasizing the need to enhance inclusivity, strengthen fairness, and adopt group-specific strategies to foster both tax burden intention and tax compliance perception.

목차

Ⅰ. 서론Ⅱ. 이론적 배경

Ⅲ. 연구 방법

Ⅳ. 분석 결과

Ⅴ. 결론과 함의

참고문헌 (42)

- [국내문헌]

- 박승규.황창호. (2022). 정부의 코로나-19 정책수용성에 대한 연구: 정부신뢰의 조절효과를 중심으로.「한국행정논집」, 34.3: 411-434.

- 신영효. (2020). 복지확대와 추가 조세부담 결정요인.「조세연구」, 20.3: 89-113.

- 엄규숙. (2024). 한국 복지국가의 미래: 발전복지국가로부터 경로이탈적 변동 가능성.「현상과인식」, 48.2: 15-46.

- 오종현. (2024).「납세의식과 납세순응행위 결정 요인 분석. 조세재정Brief, 169호」, 한국조세재정연구원.

- 참여연대. (2024). 감세 및 증세 현안 등 조세·재정정책 국민여론조사.

- 한국경제연구원. (2021). 조세부담 국민 인식 조사.

- 홍범교. (2024).「지속가능한 사회를 위한 고찰- 양극화 완화를 위한 조세정책에서 정치철학까지」, 한국조세제정연구원.

- [외국문헌]

- Abbiati, L., Antinyan, A., & Corazzini, L. (2020). A survey experiment on information, taxpayer preferences, and perceived adequacy of the tax burden. Heliyon, 6(3).

- Alm, J. (2019). What motivates tax compliance? Journal of Economic Surveys, 33(2): 353-388.

- Alm, J., McClelland, G. H., & Schulze, W. D. (1992). Why do people pay taxes? Journal of Public Economics, 48(1): 21-38.

- Alm, J., & Torgler, B. (2006). Culture differences and tax morale in the United States and in Europe. Journal of Economic Psychology, 27(2): 224-246.

- Chan, C. W., Troutman, C. S., & O'Bryan, D. (2000). An expanded model of taxpayer compliance: Empirical evidence from the United States and Hong Kong. Journal of International Accounting, Auditing and Taxation, 9(2): 83-103.

- Gugushvili, D. (2022). Determinants of the willingness to pay higher taxes for better public healthcare services: Cross-national analysis. Journal of Social Service Research, 48(3): 416-429.

- Guo, Y., & Gong, T. (2024). The impact of tax burden on welfare attitudes: Micro evidence from welfare states. PLOS ONE, 19(11), e0311047.

- Helliwell, J. F., & Huang, H. (2008). How's your government? International evidence linking good government and well-being. British Journal of Political Science, 38(4): 595-619.

- Hite, P. A., & Roberts, M. L. (1991). An experimental investigation of taxpayer judgments on rate structure in the individual income tax system. Journal of the American Taxation Association, 13(2).

- Hvidberg, K. B., Kreiner, C. T., & Stantcheva, S. (2023). Social positions and fairness views on inequality. Review of Economic Studies, 90(6): 3083-3118.

- Jacoby, W. G. (1994). Public attitudes toward government spending. American Journal of Political Science, 38(2): 336-361.

- Kasipillai, J., Aripin, N., & Amran, N. A. (2003). The influence of education on tax avoidance and tax evasion. eJournal of Tax Research, 1(2): 134-146.

- Kirchler, E. (2007). The economic psychology of tax behaviour. Cambridge University Press.

- Kirchler, E., Hoelzl, E., & Wahl, I. (2008). Enforced versus voluntary tax compliance: The "slippery slope" framework. Journal of Economic Psychology, 29(2): 210-225.

- Meltzer, A. H., & Richard, S. F. (1981). A rational theory of the size of government. Journal of Political Economy, 89(5): 914-927.

- Murphy, K. (2004). The role of trust in nurturing compliance: A study of accused tax avoiders. Law and Human Behavior, 28(2): 187-209.

- Njunwa, P., & Batonda, G. (2023). Effect of taxpayer education on voluntary tax compliance among small and medium enterprises, Mwanza City, Tanzania. Global Scientific and Academic Research Journal of Economics, Business and Management, 2(11): 148-198.

- OECD. (2024). OECD Revenue Statistics.

- Oorschot, W. V. (2000). Who should get what, and why? On deservingness criteria and the conditionality of solidarity among the public. Policy & Politics, 28(1): 33-48.

- Ortega, D., & Sanguinetti, P. (2016). Reciprocity and willingness to pay taxes: evidence from a survey experiment in Latin America. Economía, 16(2): 55-87.

- Piff, P. K., Kraus, M. W., Côté, S., Cheng, B. H., & Keltner, D. (2010). Having less, giving more: The influence of social class on prosocial behavior. Journal of Personality and Social Psychology, 99(5): 771-784.

- Richardson, G. (2006). Determinants of tax evasion: A cross-country investigation. Journal of International Accounting, Auditing and Taxation, 15(2): 150-169.

- Rothstein, B. (2000). Trust, social dilemmas and collective memories. Journal of Theoretical Politics, 12(4): 477-501.

- Susanto, A., Yusriadi, Y., Sahid, A., Sucahyo, U. S., & Tenrini, R. H. (2023). Quality of e-tax system and tax compliance intention: The mediating role of user satisfaction. Administrative Sciences, 13(1): 22.

- Svallfors, S. (1997). Worlds of welfare and attitudes to redistribution: A comparison of eight western nations. European Sociological Review, 13(3): 283-304.

- Svallfors, S. (2006). The moral economy of class: Class and attitudes in comparative perspective. Stanford University Press.

- Svallfors, S. (2012). Contested welfare states: Welfare attitudes in Europe and beyond. Stanford University Press.

- Torgler, B. (2007). Tax compliance and tax morale: A theoretical and empirical analysis. Edward Elgar.

- Tyler, T. R. (2000). Social justice: Outcome and procedure. International Journal of Psychology, 35: 117-125.

- Van Ryzin, G. G., Muzzio, D., Immerwahr, S., Gulick, L., & Martinez, E. (2004). Drivers and consequences of citizen satisfaction: An application of the American Customer Satisfaction Index model to New York City. Public Administration Review, 64(3): 331-341.

- Wenzel, M. (2002). Tax compliance and the psychology of justice: Mapping the field. In Taxing democracy. 41-70.

- Wenzel, M. (2004). An analysis of norm processes in tax compliance. Journal of Economic Psychology, 25(2): 213-228.

- Wenzel, M. (2007). The multiplicity of taxpayer identities and their implications for tax ethics. Law & Policy, 29(1): 31-50.

참고문헌 더보기

경인행정학회

경인행정학회